The 20 hottest open source startups of 2025

AI agents with everything

Welcome to Forkable’s Open Profile column, where I profile startups and key figures from across the open source realm.

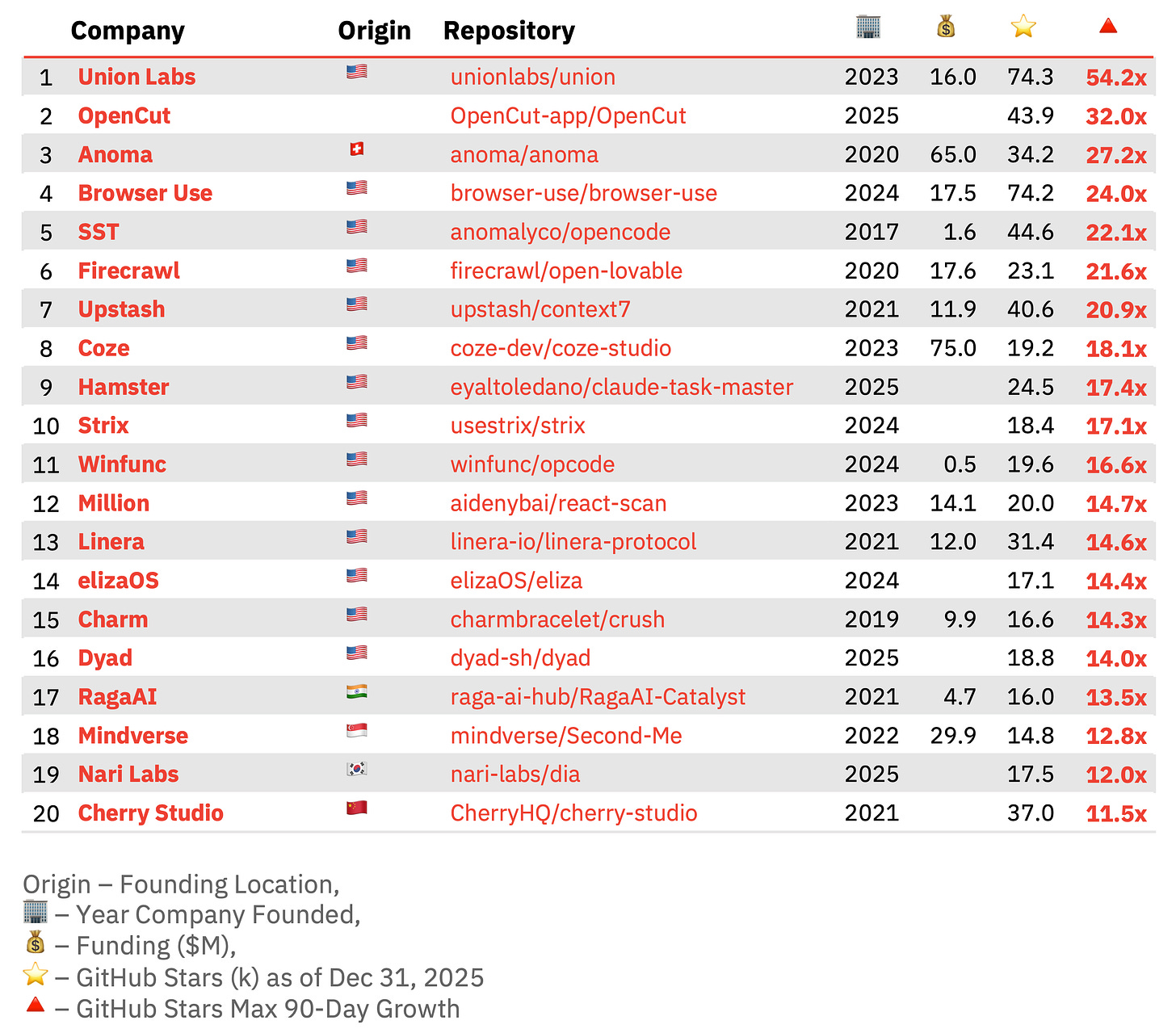

In this edition, I look at a new report that ranks the 20 fastest-growing commercial open source software (COSS) startups in the world, using GitHub growth data to surface projects that gained the most developer attention over the past year.

The ranking hails from Runa Capital, a European venture capital firm that invests in early-stage open source software companies, and which publishes the Runa Open Source Startup (ROSS) Index. The index has been running since 2020 and produces quarterly updates on fast-growing repositories, alongside an annual report highlighting the most popular COSS projects in a given year.

At the top of the 2025 index, the picture is relatively mixed, with rapid growth spread across blockchain infrastructure, developer tooling, and creative software. Further down the ranking, however, something of a trend emerges, with a growing concentration of projects focused on AI agents and agent-driven tooling.

Read the story in full below.

Finding momentum in COSS startups

By way of a brief recap, the ROSS Index is heavily curated and explicitly doesn’t track all open source projects. It focuses specifically on vendor-led startups with commercial ambitions. Projects must be linked to an independent company, be under 10 years old, and fall below a funding threshold. Side projects, community-only efforts, and subsidiaries of larger firms are not included.

Broadly, the index is used to highlight early momentum in open source companies before meaningful revenue or customer adoption. GitHub stars are used as a signal of developer interest, as opposed to a measure of usage in production.

Last year’s annual report showed strong demand for AI and data infrastructure tools, with developer platforms and AI-adjacent projects dominating the top of the ranking. Ollama took the top spot in the 2024 index, after its open source tooling for running large language models locally gained widespread developer attention.

High-five for open source

Leading the 2025 ranking is Union Labs, which recorded a peak growth rate of 54.2x and reached 74.3K GitHub stars. Founded in 2023 in Dover, Delaware, Union Labs is building a modular, zero-knowledge interoperability layer designed to link blockchains.

Second in the list is OpenCut, which has now reached 43.9K GitHub stars with a peak growth rate of 32.0x. Founded in 2025, OpenCut is a cross-platform open source video editor, and its rapid rise reflects strong developer interest in open source creative tooling.

Third is Anoma, which recorded 34.2K GitHub stars and a 27.2x growth rate. Founded in 2020 out of Zug, Switzerland, Anoma is developing a distributed operating system for “intent-centric, decentralised applications.”

Browser Use ranks fourth, reaching 74.2K GitHub stars with a 24.0x growth rate. Founded in 2024 in San Francisco, Browser Use builds a framework that enables AI agents to interact directly with and control web browsers.

Rounding out the top five is San Francisco-based SST / Anomaly, which reached 44.6K GitHub stars for its terminal-based coding agent OpenCode during the measurement period (ending December 31, 2025), representing a peak growth rate of 22.1x. Since then, the repository’s star count has climbed rapidly, rising to 98.1K stars — an indication of how quickly momentum can build once an open source project breaks out.

Agents at the ready

The existence of Browser Use and OpenCode at the tail-end of the top five serves as a prelude for the rest of the index, which has a heavy emphasis on AI agents.

Upstash (#7) appears in the ranking through its work on Context7, which provides up-to-date code documentation designed for use by AI agents. Coze (#8), meanwhile, focuses more directly on agent creation, offering a visual environment for building and managing autonomous systems through Coze Studio. And then there’s Strix (#10), which applies agents to security, using autonomous systems to carry out penetration testing without continuous human input.

Elsewhere in the list is ElizaOS (#14), which positions itself as a framework for building agents with longer-lived personalities, while Charm’s terminal-based coding agent Crush (#15) reflects growing interest in embedding agent behaviour directly into developer workflows.

That cluster of agent-focused projects also highlights a broader shift in how quickly open source software is now being built and adopted. According to Runa Capital, the time it takes for new repositories to hit meaningful milestones — whether stars, contributors, or closed issues — has shortened sharply compared with previous years. Earlier breakout projects tended to grow more gradually, while newer entries are reaching comparable levels of attention within a single quarter.

“The biggest explosion happened toward the end of 2025 and continues into early 2026 — agents now make it significantly faster and easier to build products,” Eugene Chernyavsky, data lead at Runa Capital, explained to Forkable.

That acceleration has made it easier for teams to build and iterate, but it has also intensified competition. Faster development cycles mean many open source products are now easier to replicate than they were even a year ago, requiring less time, smaller teams, and fewer person-hours to produce comparable software. While the longer-term economic impact of this shift remains unclear, its immediate effect is visible in the data: growth is increasingly concentrated around a smaller number of breakout projects.

“Projects that truly gain popularity now are those with genuinely unique—sometimes brilliant—ideas or near-perfect market fit,” Chernyavsky said. “We’re seeing significantly more of these breakout projects.”

Methodology

According to Chernyavsky, the methodology for the 2025 index remains largely consistent with previous years, with minor refinements.

Repositories are required to pass a baseline of at least 1,000 GitHub stars before being considered. Growth is then measured across the highest-performing 90-day observation window, rather than shorter periods that tend to capture brief spikes in attention. Each entry records the quarter of peak performance, the growth multiplier, and the star count as of December 31, 2025.

“Our experience with past indices shows that capturing projects with explosive star growth is effective for identifying promising startups,” Chernyavsky said. “We don't aim to measure production adoption within this index, as that takes significantly longer to materialize. Our goal is to highlight trending startups—those that broke out in 2025 and attracted the most interest. The typical cycle for projects to achieve significant customer adoption exceeds a year. We can't wait that long; we want to surface interesting projects as soon as they emerge.”